Trevi Group: sale of the oil & gas division to the indian group Meil for approx. euro 116 million

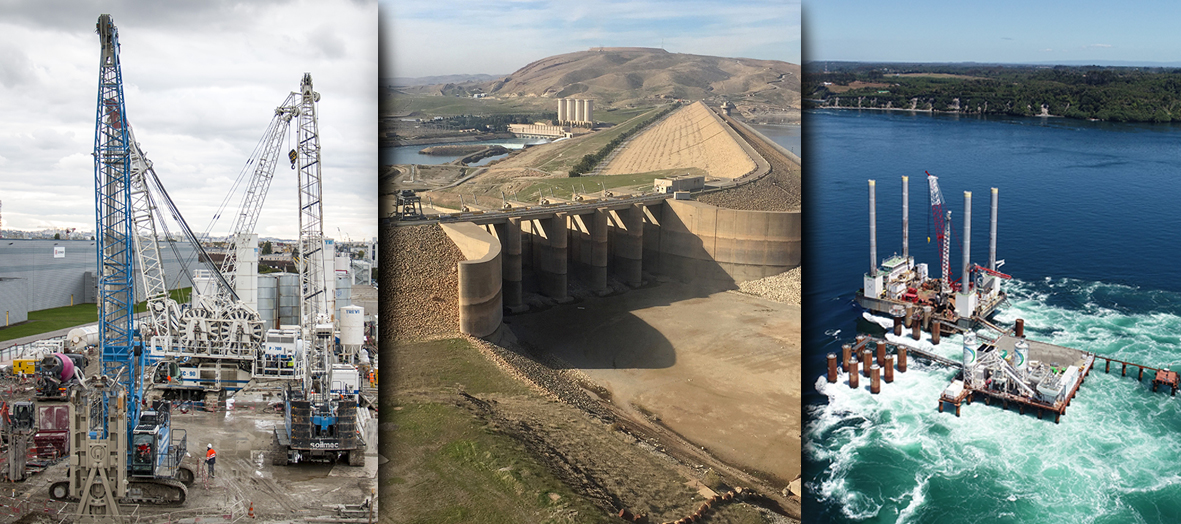

• THE GROUP CAN NOW FOCUS AGAIN ON THE CORE BUSINESS OF THE FOUNDATIONS

• THE CAPITAL INCREASE IS THE NEXT STEP IN THE RECOVERY PLAN

Cesena, March 31, 2020 – Trevi – Finanziaria Industriale S.p.A. (the “Company”) informs that between March 30, 2020 and the date hereof it has been successfully executed the second part of the closing for the sale of the Oil&Gas Division of Trevi Group to MEIL Global Holdings BV, company part to the group led by the Indian infrastructure company Megha Engineering & Infrastructures Ltd (the “MEIL Group”). The first part of the closing had been already executed on last February 28 (for additional information please see the press release of February 28, 2020 available on Company’s website www.trevifin.com, section “Investors Relations/Press Releases”).

More in particular, the entire share capital of Drillmec S.p.A., Drillmec Inc. and Petreven S.p.A. (net of the minority shareholding already transferred to MEIL Group on last February 28) has been transferred to MEIL Group for an overall purchase price equal to, pursuant to the sale and purchase agreement entered into on August 5, 2019, as amended (the “SPA”), approx. Euro 116.4 million of which approx. Euro 22.0 million had been already paid by MEIL Group before the date hereof.

Part of the purchase price paid by MEIL Group shall be used by Trevifin, before the launch of the capital increase, to repay to the financial creditors part of the outstanding debts of the Oil&Gas division, which have been previously assumed by Trevifin, in accordance with the restructuring agreement entered into on August 5, 2019 and homologated by the Court of Appeal of Bologna on January 10, 2020 (the “Restructuring Agreement”).

“I am delighted that, also thanks to the cooperative approach of MEIL Group, the Trevi Group has been able to finalize this transaction, that is an important milestone in the restructuring process of Trevi Group, despite the enormous difficulties that we are facing due to Covid-19 outbreak”, said Mr. Sergio Iasi, CRO of Trevi Group. “With the execution of the capital increase resolved by the board of directors on last July 17, expected to be completed by this May, the restructuring process will be completed, with a new start for the Trevi Group, bringing both challenges and opportunities.”

"With the sale of the Oil & Gas - says Mr. Giuseppe Caselli, CEO of the Trevi Group - we can focus more and more on strategic priorities such as strengthening our core business along with our growth, both in terms of volumes and profitability of our activities. Since the previous months, we have been working to optimize and improve our organization and processes in order to make them functional to the pursuit of our objectives. Although the Covid-19 pandemic is paralyzing the whole world, and considering that the prospects of a quick return to regular activity are still uncertain, we are aware of our potential and very confident of what we sowed before and during the crisis. Furthermore, 2 if we consider that the Group can count on a territorial diversification – which can certainly ease our work in extraordinary phases such as these - we can say that we are ready to take advantage of all the opportunities that will arise”.

“It is our honour to welcome Drillmec and Petreven into the MEIL Group. Even in these difficult time of Covid-19, MEIL Group stood up to its commitment and completed this acquisition also with the support and professional cooperation of the Trevi Group. The additional size and scale provided from this acquisition serves to strengthen MEIL global footprint by making inroads into global oil and gas business. In light of more than three decades of high-engineered products, MEIL Group ensures that this business will keep to deliver hi-tech rigs in the energy markets. I wish good luck and look forward to working along with all dedicated employees, clients and business partners of the group companies of Drillmec and Petreven in creating cutting-edge operations worldwide”, says Mr. Srinivas Bommareddy, President of the MEIL Group.

The transaction has been led by the Chief Restructuring Officer, Mr. Sergio Iasi, with the support, as advisors of the Company, of Gianni, Origoni, Grippo, Cappelli & Partners, Tremonti Romagnoli Piccardi e Associati, Steptoe & Johnson LLP, Morgan, Lewis & Bockius and PricewaterhouseCoopers, for the legal aspects, by Vitale & Co., Lazard & Co., Stamford Avenue Partners S.A.S., Parks, Paton, Hoepfl & Brown, LLC and Simmons Energy (Division of Piper Jaffray Ltd.) for the financial aspects.

MEIL Group has been assisted by Link Legal India Law Services, Gemma & Partner and Gatti Pavesi Bianchi, for the legal aspects, and by Artha Arbitrage Consulting LLP, for the financial aspects.

English

English  Italiano

Italiano